north carolina estate tax 2021

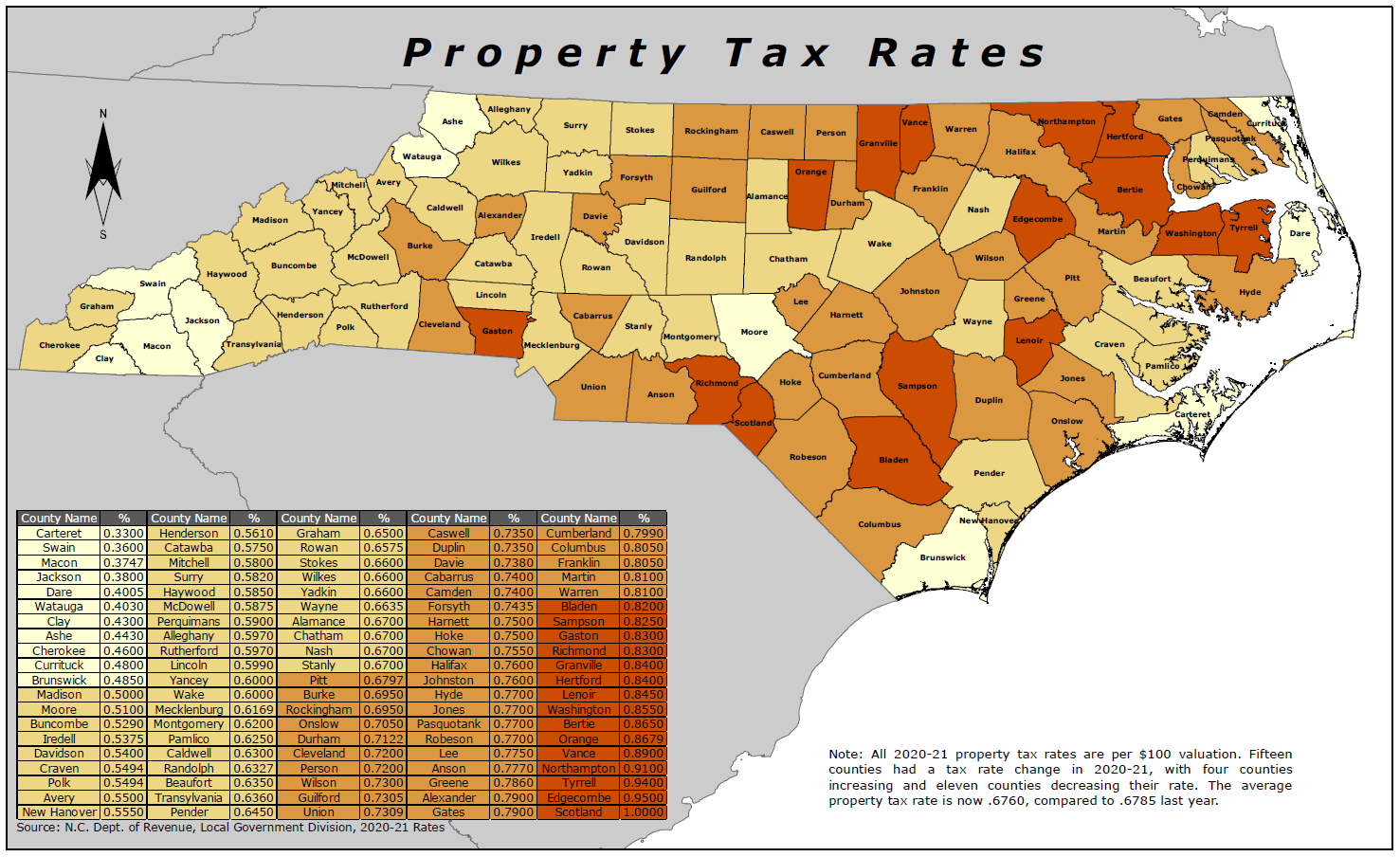

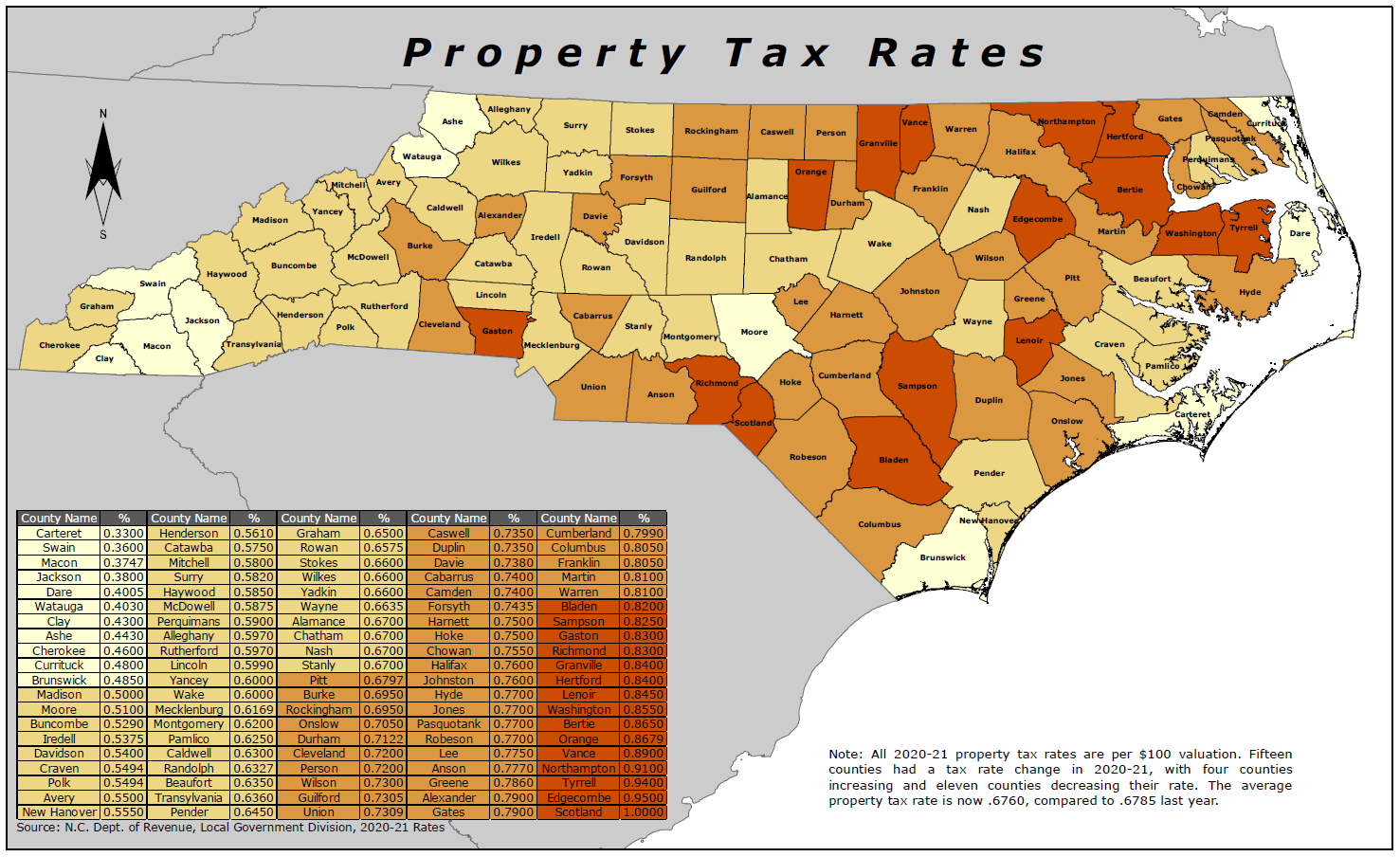

Tax amount varies by county The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. In addition the Tax Relief Unemployment Insurance Reauthorization and Job Creation Act HR.

North Carolina Estate Tax Everything You Need To Know Smartasset

The state of North Carolina offers a standard deduction for taxpayers.

. Federal exemption for deaths on or after January 1 2023. Link is external 2021. North Carolina has a state sales tax of 4 and allows local governments to collect local sales tax.

Its at 59 million as of 2021 with a top tax rate of 16. Note that this applies to all reopened estates not just those for decedents dying on or after January 1. Beneficiarys Share of North Carolina Income Adjustments and Credits.

So if you live in N. 4853 was enacted in 2010 and among other things it made the estate tax exclusion portable. Up to 25 cash back However now that North Carolina has eliminated its estate tax most wealthy North Carolina residents will owe estate taxes only to the federal government.

Transfer taxes in North Carolina are typically paid by the seller. Depending on local municipalities the total combined tax rate can be as high as 75 effective in Durham Orange and Person County and as low as 675. NC K-1 Supplemental Schedule.

Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. The exemption was then scheduled to continue to increase on an annual basis until it matches the federal estate tax exemption in 2019. Carolina but inherit assets from an estate in another estate you could have to pay inheritance tax.

The tax rate on funds in excess of the exemption amount is 40. Select the North Carolina city from the list of popular cities below to see its current sales tax rate. The tax rate increases to 16 for amounts of at.

North Carolina currently does not enforce an estate tax often referred to as the death tax. The state of North Carolina requires you to pay taxes if you are a. What Is the North Carolina Estate Tax.

North Carolina Department of Revenue. The state sales tax rate in North Carolina is 4750. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020.

078 of home value. The federal estate tax exemption is 1206 million in 2022 so only estates larger than that amount will owe federal estate taxes. See below for a chart of historical Federal estate tax exemption amounts and tax rates.

2021 North Carolina General Statutes Chapter 105 - Taxation Article 1A - Estate Taxes. For Tax Year 2019 For Tax. North Carolina estate tax.

After Aunt Ruths estate deducts the exemption she would only owe gift and estate taxes on the remaining 155 million taxed at the rate of 40 percent. This means that a surviving spouse could use the exclusion that would have been available to the deceased spouse. For example a 600 transfer tax would be imposed on the sale of a 300000 home.

How Much Are Transfer Taxes in North Carolina. North Carolina Department of Revenue. And with careful estate.

North Carolina NC Sales Tax Rates by City. Owner or Beneficiarys Share of NC. The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000.

Tax amount varies by county. In fact the IRS does not have an inheritance tax while some states do have one. North Carolina has recent rate changes Fri Jan 01 2021.

Individual income tax refund inquiries. Individuals effectively shield 1206 million for 2022 or 117 million for 2021 from estate taxes assuming they never breached an annual gift tax exclusion in their lifetime. Seven counties in North.

When ownership in North Carolina real estate is transferred an excise tax of 1 per 500 is levied on the value of the property. Any federal or state gift and estate tax due however is paid by the estate during the probate of the estate. Skip to main content Menu.

PO Box 25000 Raleigh NC 27640-0640. On April 1 2014 New York made significant changes to its estate tax laws by increasing the states exemption to 2062500. Starting in 2022 the exclusion amount will increase annually based on.

105-321 - Repealed by Session Laws 2013-316 s7a effective January 1 2013 and applicable to the estates of decedents dying on or after that date. The 2021 standard deduction allows taxpayers to reduce their taxable income by 10750 for single filers 21500 for married. For the year 2016 the lifetime exemption amount is 545 million.

Fortunately few states impose an inheritance tax. As of December 2021 the average state and local sales tax in North Carolina is 69. North Carolina has no inheritance tax or gift tax.

The initial filing fees General Court of Justice fee facilities fees etc do not apply. Home File Pay Taxes Forms Taxes Forms. The 040 per 10000 or major fraction thereof of new property coming into the estate after the reopening is the only fee charged for reopened estates.

The current Federal Estate Tax Exemption for 2021 is 117 million per individual. With local taxes the total sales tax rate is between 6750 and 7500. Counties in North Carolina collect an average of 078 of a propertys.

Application for Extension for Filing Estate or Trust Tax Return.

Revealed Living In South Carolina Vs North Carolina This May Surprise You Youtube

North Carolina Sales Tax Small Business Guide Truic

Top 10 Best Places To Retire In North Carolina Smartasset

Where Is My Nc Tax Refund The State Said A Delay Pushed Back The Refunds But Hopes All Will Be Completed By End Of April Abc11 Raleigh Durham

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Guide To Nc Inheritance And Estate Tax Laws Hopler Wilms Hanna

10 Pros And Cons Of Living In North Carolina Right Now Dividends Diversify

Property Tax North Carolina Association Of County Commissioners North Carolina Association Of County Commissioners

Medicare Premiums And Deductibles Updated For 2021 Estate Planning Estate Planning Attorney Medicare

The Ultimate Guide To North Carolina Real Estate Taxes

A Guide To North Carolina Inheritance Laws

11 Things To Know Before Moving To Hickory Nc

North Carolina Tax Reform North Carolina Tax Competitiveness

Pros And Cons Of Moving To North Carolina Youtube

North Carolina State Taxes 2022 Tax Season Forbes Advisor

Who S Running For Congress In North Carolina See Where 2022 Candidates Are Competing Wral Com

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

The Ultimate Guide To North Carolina Property Taxes

North Carolina Estate Tax Everything You Need To Know Smartasset